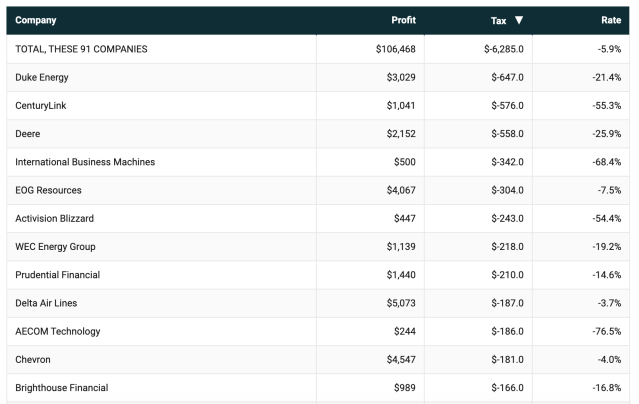

Measuring corporate tax rate and tax base avoidance of U.S. Domestic and U.S. multinational firms - ScienceDirect

Measuring corporate tax rate and tax base avoidance of U.S. Domestic and U.S. multinational firms - ScienceDirect

UK by far the biggest enabler of global corporate tax dodging, groundbreaking research finds | The Independent | The Independent

/cdn.vox-cdn.com/uploads/chorus_asset/file/22298491/1230992823.jpg)

/Intuit_turbotax-0206f28a2b074295a8489c74f345ca6d.jpg)