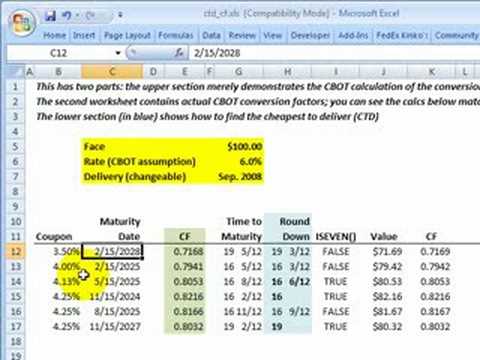

𝐄𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐇𝐲𝐩𝐞 on Twitter: "This brings us to the Cheapest to Deliver concept and the page on Bloomberg (DLV<GO>) When you short a fut, you will deliver a bond. You must

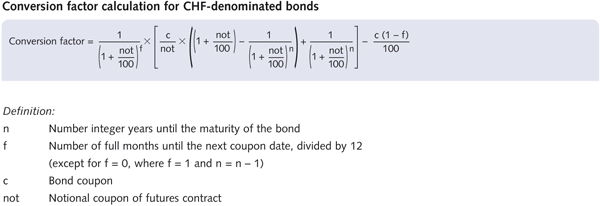

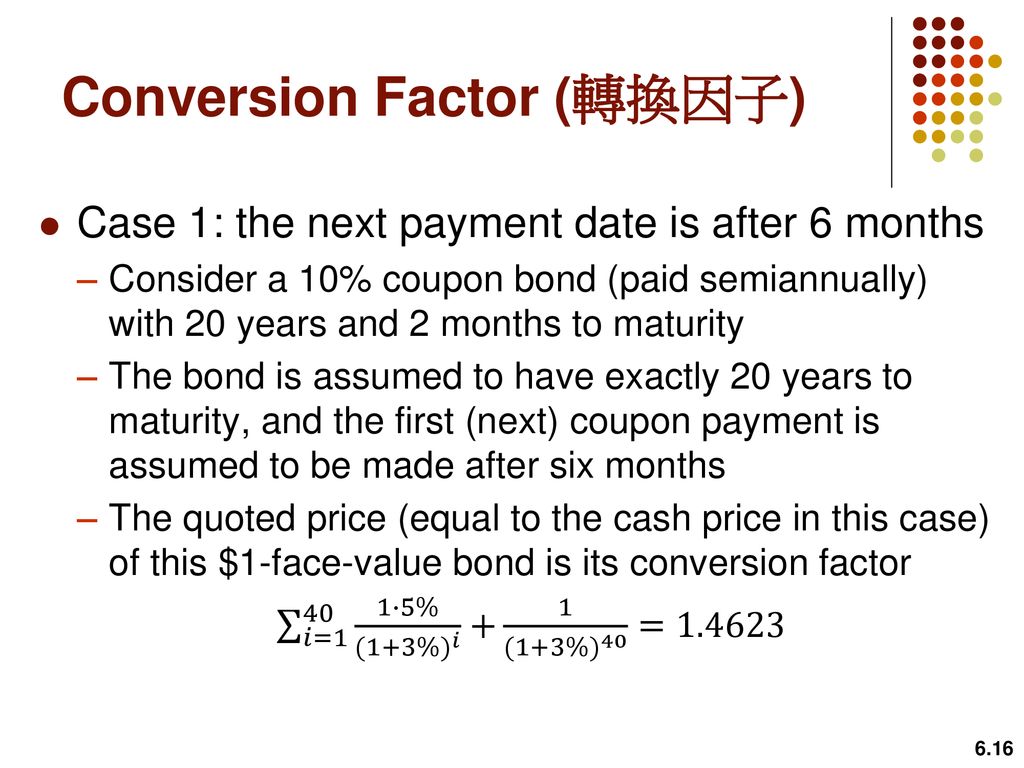

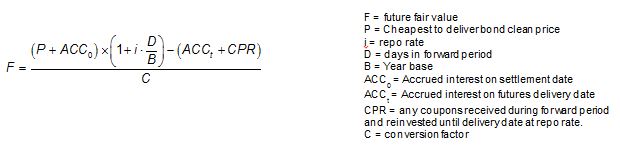

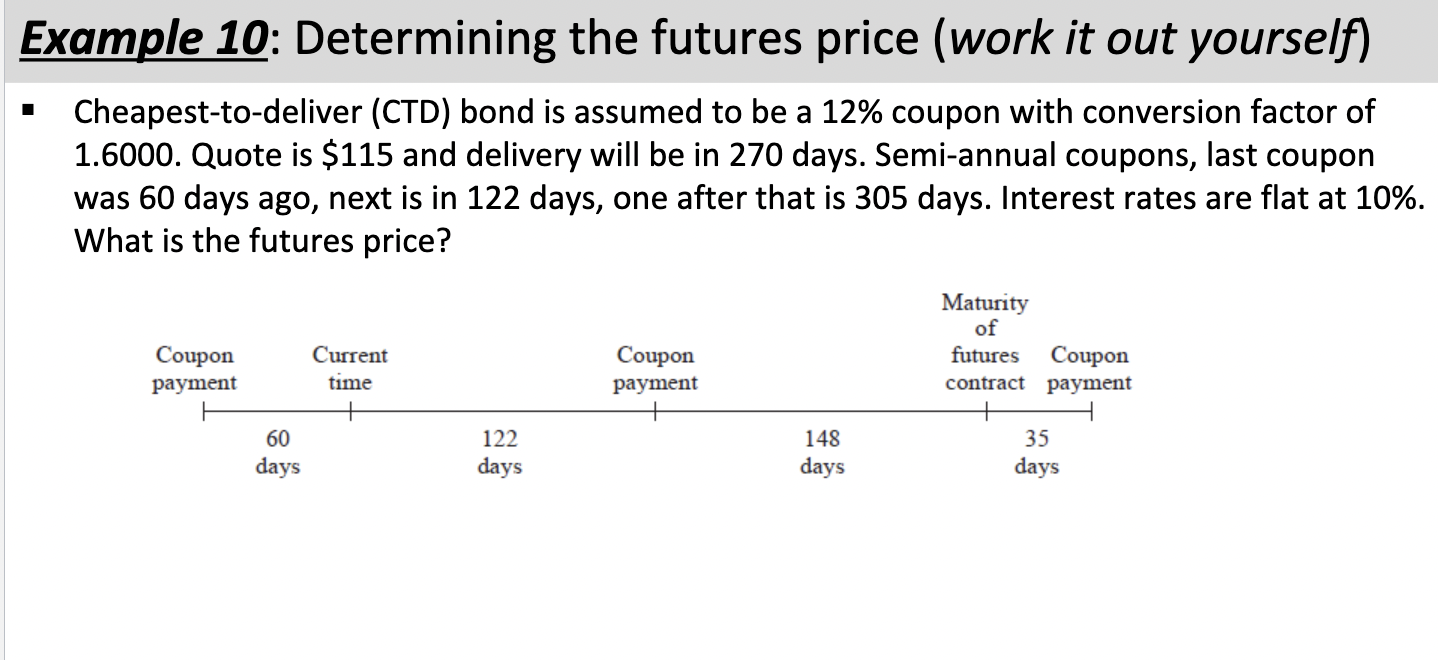

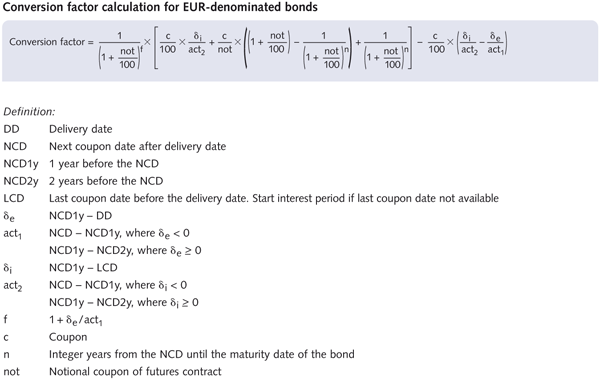

Lecture 7. Topics Pricing Delivery Complications for both Multiple assets can be delivered on the same contract…unlike commodities The deliverable. - ppt download

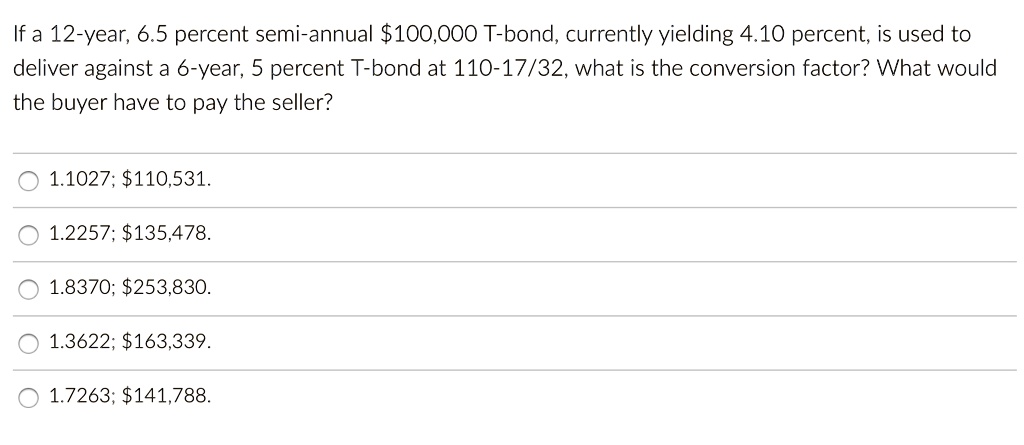

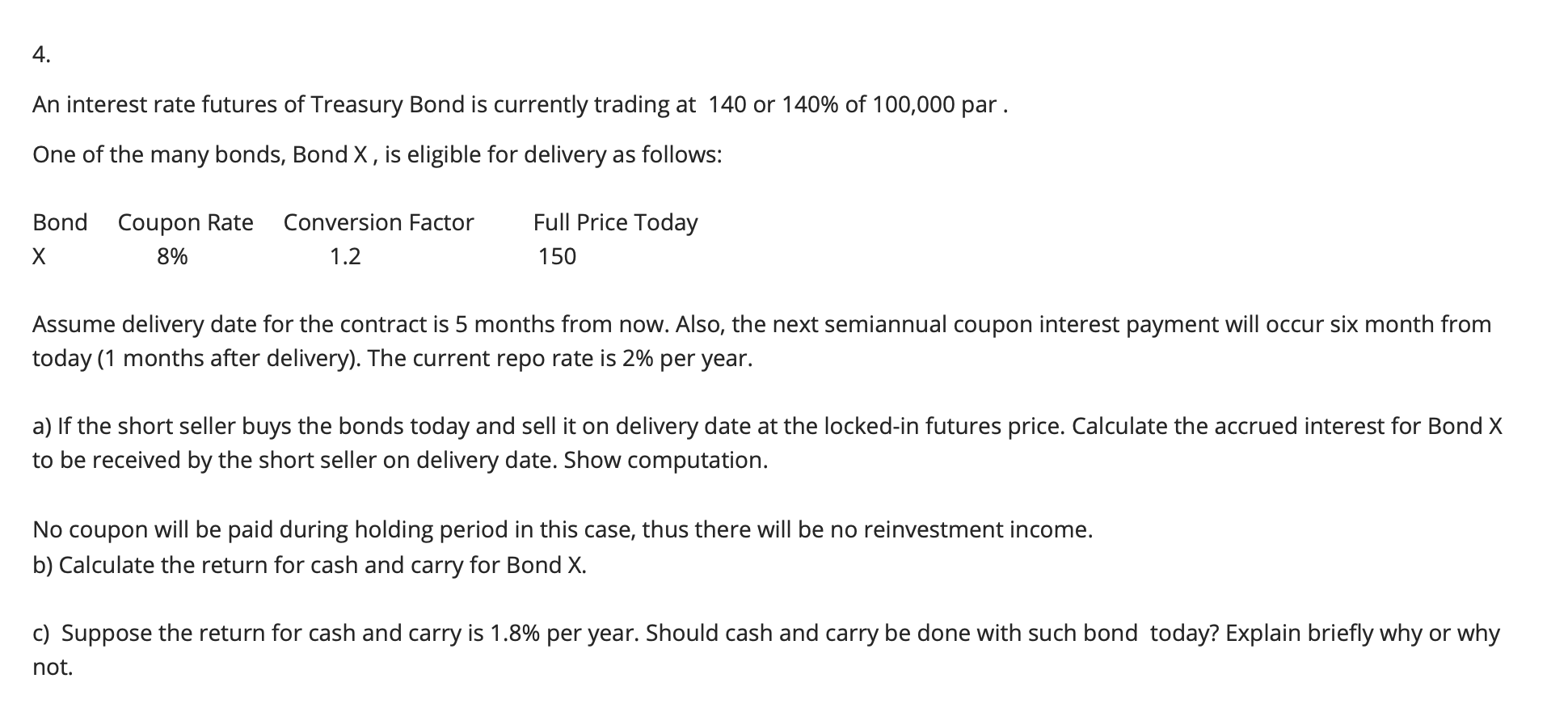

Lecture 7. Topics Pricing Delivery Complications for both Multiple assets can be delivered on the same contract…unlike commodities The deliverable. - ppt download

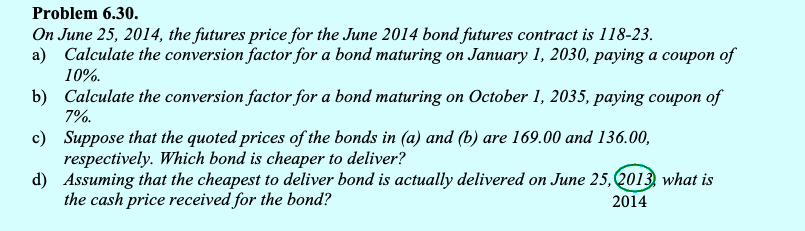

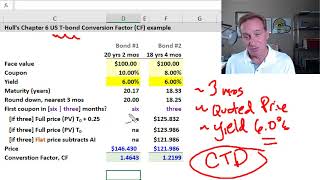

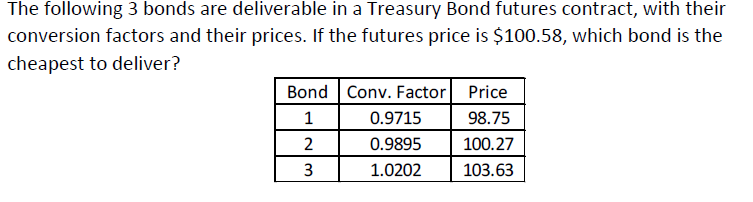

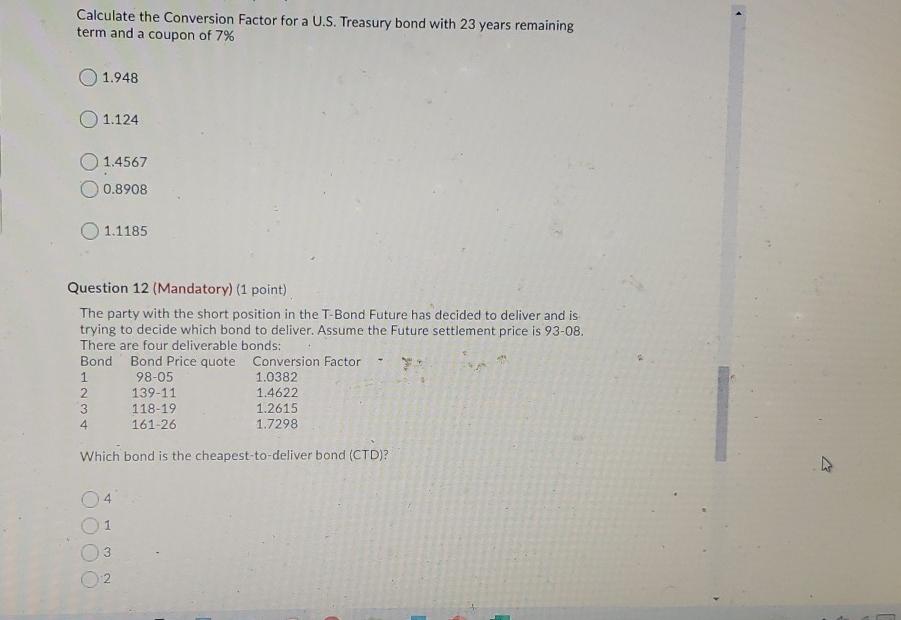

P1.T3.720. US Treasury bonds: conversion factors, cheapest-to-deliver & theoretical futures price | Forum | Bionic Turtle

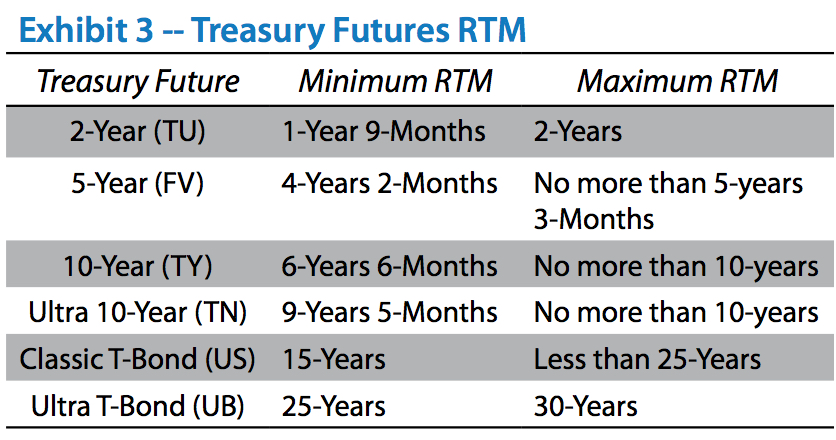

INTEREST RATES - Spreading Treasury Futures and Deliverable Swap Futures - Advantage Futures Futures Brokers | Futures and Options Commodities Broker