Next Level Risk-Based Pricing is Coming: Beyond Decisioning and Pricing is Outcome Analysis – AffirmX

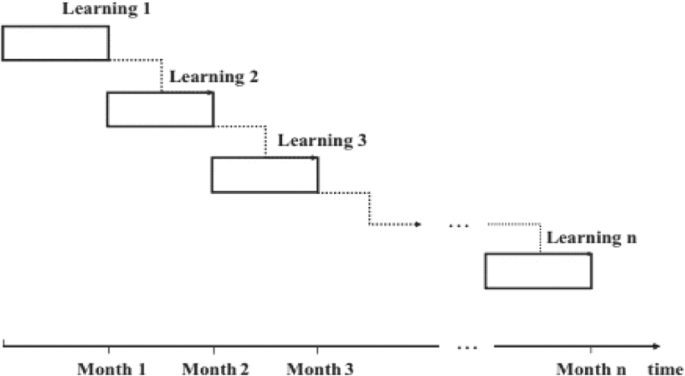

A dynamic credit risk assessment model with data mining techniques: evidence from Iranian banks | Financial Innovation | Full Text

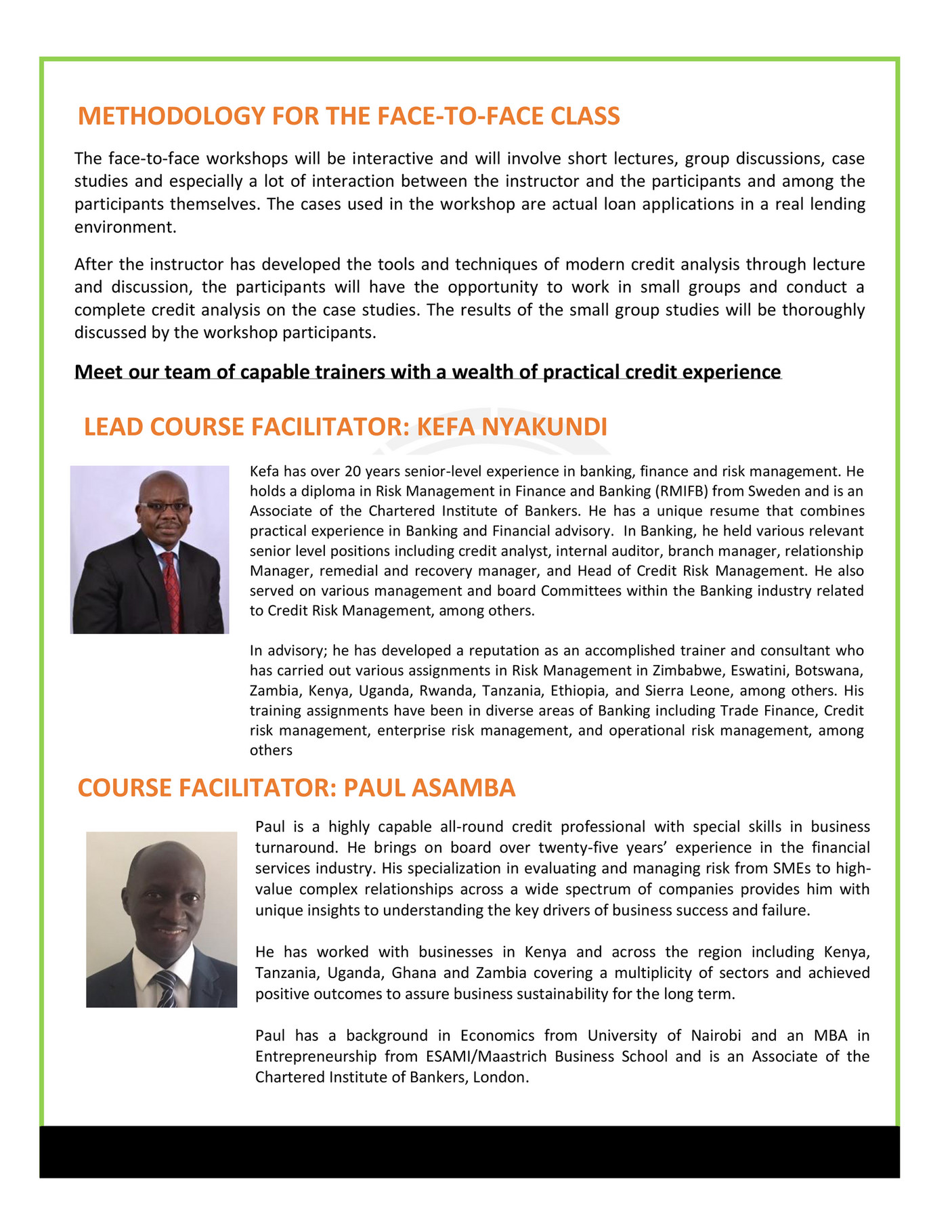

Africa Risk Institute - FUNDAMENTALS OF CREDIT RISK MANAGEMENT_Rwanda - Page 4-5 - Created with Publitas.com

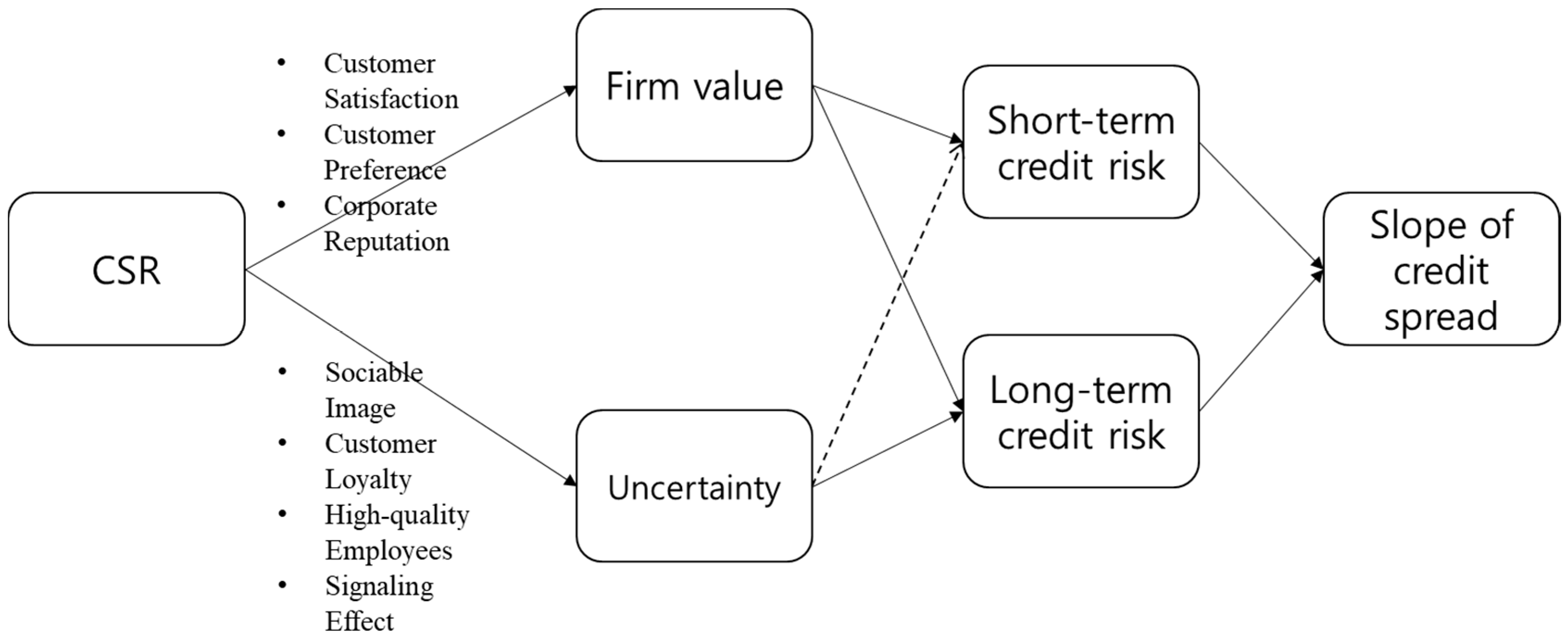

Sustainability | Free Full-Text | Do Corporate Social Responsibility Activities Reduce Credit Risk? Short and Long-Term Perspectives

/investopedia5cscredit-5c8ffbb846e0fb00016ee129.jpg)